Type of File Number 2 alphabets characters SG or OG space Income Tax Number maximum 11 numeric characters Example. Download a copy of the form and fill in your details.

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

The unique reference number assigned to you by LHDN.

. Partnership income tax no. A copy 1 an acknowledgement letter from Malaysia Institute of Accountants MIA if relevant and 9. For example the file numbers of individual residents and non-residents are SG and OG and the companys file number is C.

Uncategorized tax identification number malaysia example. TF or C etc space Income Tax Number Maximum 10 numeric characters. For example for the year 2016 filing starts on 1st March 2017 and ends on 30th April 2017.

SG 10234567090 or OG 25845632021 For individual ITN the end number can be either 0 or 1 which indicates the husband or wife. Go back to the previous page and click on Next. Supporting Documents If you have business income.

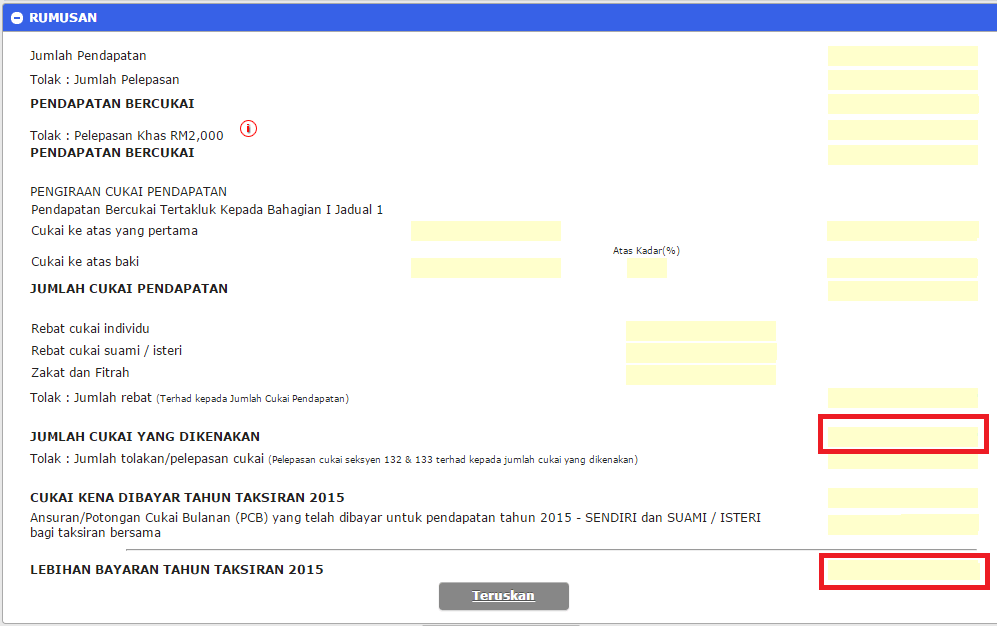

Fill in the Information. Do all categories of. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040.

Type of File Number 2 alphabets characters SG or OG space Income Tax Number 11 numeric characters Example. Your Income Tax Number is a unique reference number that is to be used by you in all dealings with the Inland Revenue Board of Malaysia Malay. Click on e-Filing PIN Number Application on the left and then click on Form CP55D.

Individuals who earn income from business. Click on Permohonan or Application depending on your chosen language. For example in the UK individuals have a National Insurance NI number and companies have a Corporation Tax.

Lembaga Hasil Dalam Negeri Malaysia abbreviated LHDNM. A 10-digit number assigned by SARS to each taxpayer upon registration as a taxpayer is known as an income tax reference number. If you are not registered you can find your tax number on your tax return.

To get the tax number you have to prepare several documents related to your job. Partnership ABC Partner Apportionment of ProfitLoss A. In the event that you are registered you may find your tax number on your Income Tax Workpage on eFiling provided you are an authorized eFiler.

TIN is the income tax number currently recorded by the Inland Revenue Board of Malaysia. Employees Provident Fund that manages the compulsory savings plan and retirement planning for private sector workers in Malaysia. Example for Individual File Number.

The Government during the 2022 Budget Speech tabled in the Dewan Rakyat on Friday 29 October 2021 has announced the implementation of tax identification number TIN to be implemented beginning year 2022 to broaden the income tax base. Example For Individual File Number. Lembaga Hasil Dalam Negeri Malaysia which is abbreviated LHDNM.

Social Security Organisation is an organisation that protects Malaysian employees in accordance with the Employees Social. 2471000 Basis of Apportionment. The Income Tax Number is allocated by the Inland Revenue Board of Malaysia when you register for tax.

FAQ On The Implementation Of Tax Identification Number. 03-8911 1000 local number What is Income Tax File number Malaysia. SG 10234567090 or OG 25845632021 For individual ITN the end number can be either 0.

The more you reduce your chargeable income through tax reliefs and such the lesser your final tax amount will be. D 0012345602 5 Basis of Apportionment Denominator used for apportioning the profitloss. If you are staying in Malaysia for more than 182 days in a year you are considered resident under Malaysian tax law and have to pay taxes.

SG or OG space Income Tax Number Maximum 11 numeric characters SG 10234567090 or OG 25845632021 Non-Individual File Number Type of File Number 2 alphabets characters. It is necessary for you to use your Income Tax Number also known as Lembaga Hasil Dalam Negeri Malaysia or LHDNM in all of your transactions with the Inland Revenue Board of Malaysia Malay. Individuals whose total annual income after EPF deduction is RM3400000 and above.

Telephone numbers in Malaysia are regulated by the Malaysian Communications and Multimedia Commission MCMC. Who needs to file for income tax. Partnership AB Partner Apportionment of ProfitLoss A.

Similar to Singapores CPF. A copy 1 appointment letter as a tax agent if the registration is done by a tax agent. Here are the income tax rates for personal income tax in malaysia for ya 2019.

FREQUENTLY ASKED QUESTIONS FAQ. Individual carrying on business. Application form to register an income tax reference number can be obtained from the nearest Income Tax Offices.

Here are the definitions of the mentioned statutory items. Tax identification number is an INCOME TAX NUMBER as per existing records with the Inland Revenue Board of Malaysia HASiL. Example of employment income subject to tax.

Income tax is a type of tax that the government collects from their citizens or eligible tax. No later than 30 April in the year following the assessment 1. To obtain your income tax number you should register online through e-Daftar or in person.

The timeline to file your income tax is as below. What is Tax Identification Number TIN. Type Structure Example Individual File Number Type of File Number 2 alphabets characters.

Taxes including personal income tax expenses. Category File Type Resident Individuals and Non-Resident Individuals SG OG Companies C 2. If you have registered before your income tax number will be shown see next step 4.

As an example lets say your annual taxable income is RM48000. This includes your basic salary commission bonuses etc. Now that you have a general understanding of how your income tax in Malaysia works youre ready.

The Type of File Number and the Income Tax Number. So if your basic monthly salary is RM4000 with RM100 travel allowance your gross annual income is RM49200.

The Complete Income Tax Guide 2022

.png)

How To Check Your Income Tax Number

Investing Investment Property Goods And Service Tax

How To Step By Step Income Tax E Filing Guide Imoney

How To File Your Taxes If You Changed Or Lost Your Job Last Year

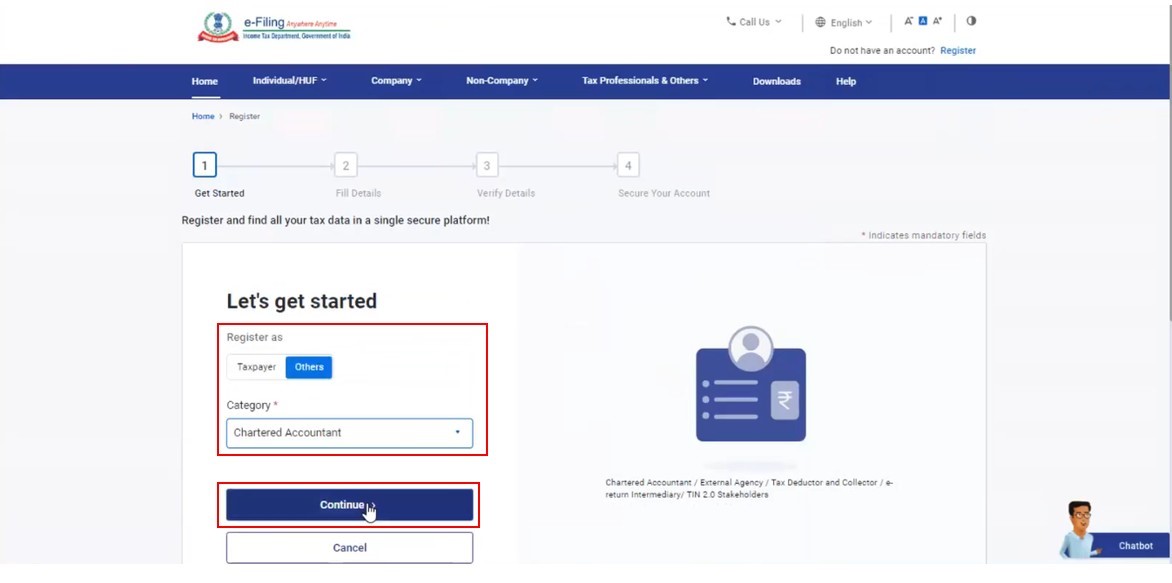

Registration Income Tax Department

Important Things In Your Payslips Need To Check Payroll Template National Insurance Number Payroll Software

How To Step By Step Income Tax E Filing Guide Imoney

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Malaysia Personal Income Tax Guide 2022 Ya 2021

Building Contractor Appointment Letter How To Create A Building Contractor Appointment Letter Download This Building C Lettering Letter Templates Templates

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Leave Application Form Word Template Application Form Templates Printable Free

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

How To Step By Step Income Tax E Filing Guide Imoney

How To Know Your Itr Status On New Income Tax Portal

How To Sell Online Payslips To Your Employees Payroll Payroll Template Things To Sell